The Of Offshore Trust Services

The 10-Minute Rule for Offshore Trust Services

Table of ContentsOffshore Trust Services Fundamentals ExplainedOffshore Trust Services Can Be Fun For EveryoneThe Ultimate Guide To Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is DiscussingThe Offshore Trust Services Ideas

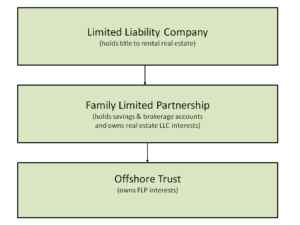

Even if a financial institution can bring a deceptive transfer insurance claim, it is tough to prosper. They have to prove past a sensible doubt that the transfer was made with the intent to rip off that specific creditor and that the transfer left the debtor financially troubled. Numerous overseas asset defense plans entail greater than one legal entity.

, which for some time has been a preferred LLC jurisdiction. Current modifications to Nevis tax as well as filing needs have actually led to LLCs in the Cook Islands.

The individual might next off develop a Cook Islands trust making use of an offshore trust firm as a trustee. The LLC issues subscription interests to the trustee of the Chef Islands trust fund.

resident might act as the first supervisor of the Nevis LLC with the option of assigning an overseas manager should the individual ever before become under legal discomfort. With this sort of offshore trust fund structure, the Nevis LLC is managed by the U.S. person when there are no expected legal actions. When a legal concern arises, the trustee of the offshore depend on need to eliminate the united state

Excitement About Offshore Trust Services

The strategy branches out control over 2 different territories instead of putting all the properties in either the LLC or the depend on. Make certain you completely understand the overseas trust structure before moving forward with it. A property security plan is much less effective when not comprehended by the judgment debtor. Right here are the 5 most crucial steps to developing an offshore count on: Select a jurisdiction with favorable overseas trust fund legislations.

Fund the depend on by moving residential assets to the offshore accounts. The first step to forming an overseas trust fund is choosing a trust fund territory.

The trustee firm will certainly utilize software application to validate your identity and also explore your current legal circumstance in the U.S. Trust fund companies do not want customers that might include the company in investigations or litigation, such as disputes involving the U.S. federal government. You have to disclose pending lawsuits and also examinations as part of the history check.

The smart Trick of Offshore Trust Services That Nobody is Talking About

Your residential property security lawyer will certainly work with the offshore trustee business to prepare the offshore count on arrangement. The depend on agreement can be personalized based on your possession protection as well as estate planning objectives.

accountancy firms, as well as they offer the audit results and their insurance certifications to potential overseas count on customers. Lots of people wish to retain control of their very own assets kept in their overseas trust fund by having the power to remove Click This Link and also change the trustee. Retaining the power to transform an offshore trustee develops legal dangers.

Overseas trust asset protection works best if the trustmaker has no control over count on properties or various other events to the count on. Some trustee business permit the trustmaker to reserve primary discretion over count on investments and also account administration in the placement of trust fund expert.

The trustmaker does not have direct accessibility to offshore depend on monetary accounts, however they can request circulations from the offshore trustee The opportunity of turn over orders as well as civil ridicule costs is a substantial threat in overseas asset protection. Debtors depending on offshore trust funds must consider the possibility of a residential court order to bring back properties moved to a borrower's overseas count on.

In instances when a court orders a debtor to take a break an overseas depend on plan, the borrower can assert that conformity is difficult because the count on is under the control of an offshore trustee. Some current court decisions treat a transfer of possessions to an overseas count on as an intentional act of producing an impossibility.

The Fannie Mae company obtained a cash judgment versus the borrower. The debtor had moved over $7 million to an overseas trustee. The trustee after that transferred the very same cash to a foreign LLC of which the borrower was the sole participant. The court got the debtor to revive the money to pay the Fannie Mae judgment.

What Does Offshore Trust Services Mean?

The overseas trustee declined, and he said useful content that the cash had been bought the LLC (offshore trust services). The court held the borrower in contempt of court. The court found that despite the rejection by the offshore trustee, the find borrower still had the ability to access the funds as the single participant of the LLC.